Invoice factoring is a financing option that allows businesses to sell their unpaid invoices to a factoring company or a factor, in exchange for immediate cash. This form of financing has been around for centuries and has played a crucial role in the growth and success of many businesses.

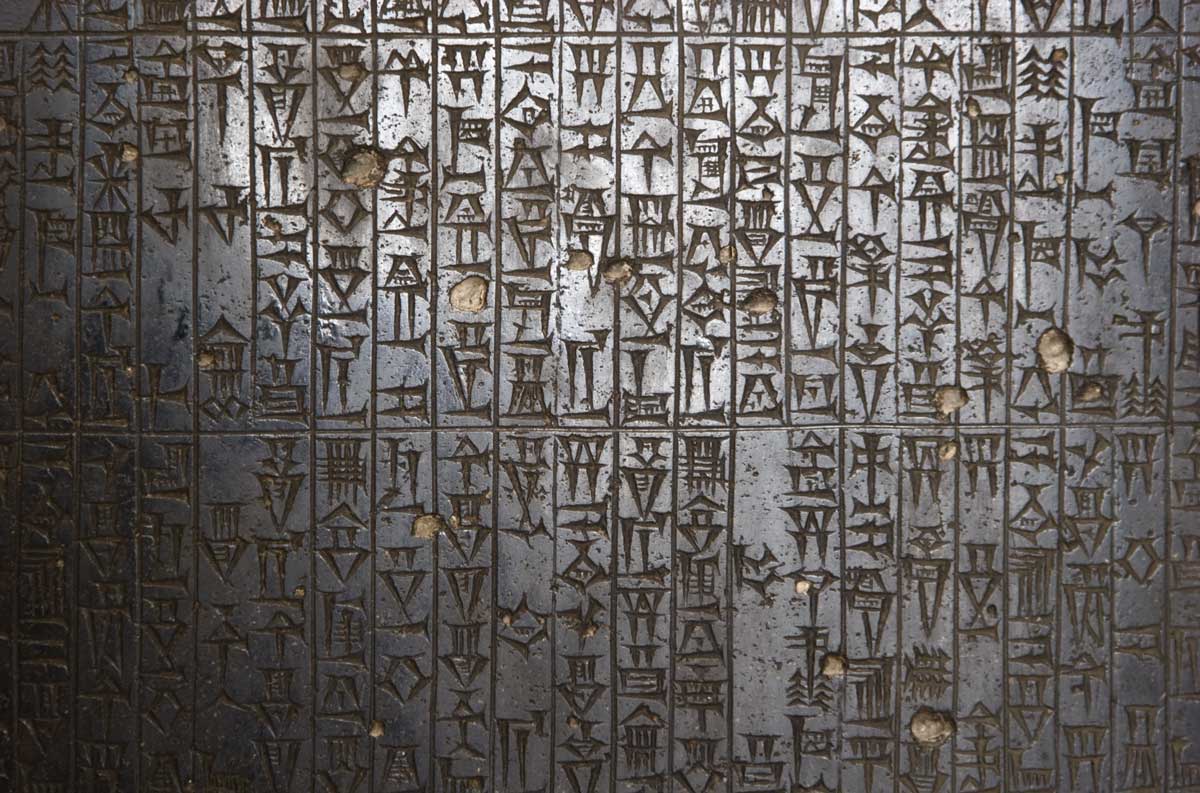

The practice of factoring invoices can be traced back to ancient Mesopotamia, where merchants would use a type of factoring known as “pawning” to finance their businesses. In this system, merchants would receive loans against their goods, which they would then pay back with interest once the goods were sold. Factoring as we know it today first emerged in Europe during the Middle Ages, where factors would purchase a merchant’s invoices at a discounted rate and then collect the full amount from the debtor. This practice allowed merchants to access capital quickly and efficiently, without having to wait for their invoices to be paid.

In the United States, invoice factoring became popular in the 1800s, when factors would purchase the accounts receivable of businesses in the textile industry. This allowed textile manufacturers to access cash quickly and invest in their businesses, leading to growth and expansion. In the 20th century, invoice factoring became more widespread, with factors providing financing to businesses across various industries.

Today, invoice factoring is a popular financing option for businesses of all sizes and industries. One of the top rated factoring companies in the United States is American Receivable. Founded in 1979, American Receivable has been providing financing solutions to businesses for over 44 years. Here are some reasons why American Receivable is the ideal partner for businesses looking to factor their invoices:

- Experience: With over 44 years of experience, American Receivable has a deep understanding of the invoice factoring industry. They have helped businesses across various industries access the financing they need to grow and thrive.

- Customized Solutions: American Receivable understands that every business is unique and has different financing needs. They offer customized solutions tailored to each business’s specific needs, ensuring that they receive the financing they need to succeed.

- Quick and Easy: American Receivable makes the factoring process quick and easy, with funding available within 24 hours. They also provide online access to account information, making it easy for businesses to keep track of their invoices and payments.

- Flexible Factoring Programs: American Receivable offers flexible factoring options with no monthly minimum commitments. Clients choose which invoices to factor as needed, without being tied to an onerous contract.

Invoice factoring has a long and rich history, and American Receivable is an excellent partner for businesses looking to access financing quickly and efficiently. With their experience, customized solutions, quick and easy process, and no long-term commitments, American Receivable is the ideal choice for businesses of all sizes and industries.

Jack Stieber jack@americanreceivable.com 972-404-4726

Brad Gurney brad@americanreceivable.com 800-297-6652

Dakota Stieber dakota@americanreceivable.com 512-339-5112