Factoring has been around for centuries. Business owners have always had a need for additional financing. And factoring accounts receivable has always been a reliable source of alternative finance. Still, factoring is typically a small part of the curriculum in most university finance departments. Let’s take a look at the history and evolution of receivable factoring.

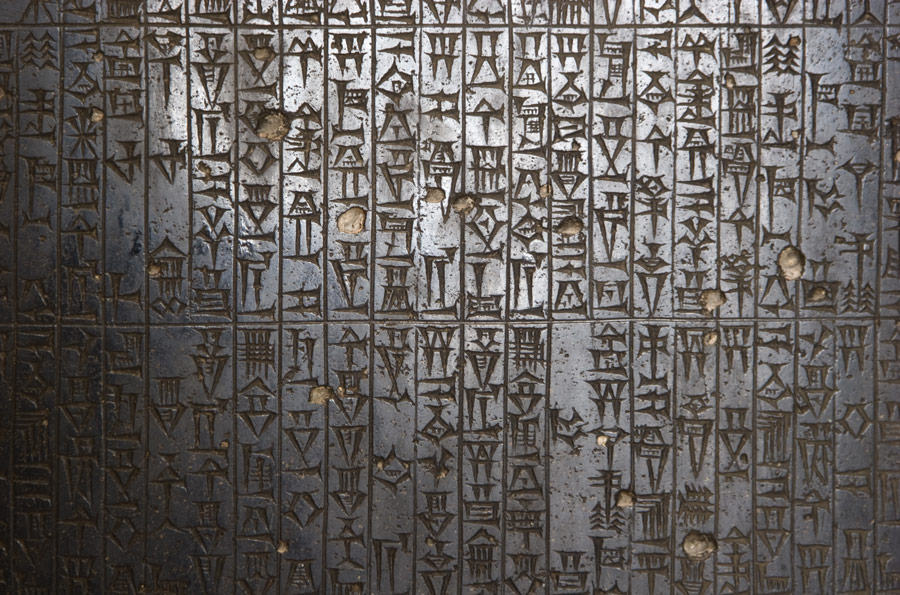

The principal of factoring began sometime during the Mesopotamian Era, around 1772 BC. The rules for factoring were first laid out in the Babylonian law code called The Code of Hammurabi. One of the oldest written code of laws in the world. This alludes that factoring was facilitating commerce very early in history.

In the early 1300’s and into the 1400’s, factoring was predominantly used by clothing merchants and traders. The “factor” would take possession of the physical goods and provide cash advances to the merchant. The “factor” would then extend the financed credit to the buyers. In the early 1600’s factoring reached North America. The famous trip the pilgrims took on the Mayflower was paid for by factoring. Colonists took quickly to the idea of factoring as they needed advances on the raw materials they were shipping across the Atlantic. When the Industrial Revolution began, the garment, textile and furniture industries relied heavily on factoring their receivables.

Factoring continued to take shape throughout the 1900’s as businesses who were not eligible for bank loans needed financing. In the 1940’s banks in the United States began offering factoring services as the need for factoring had boomed. During this time, banks and factors were now purchasing a company’s invoices or account receivables rather than taking possession of the physical goods. This idea transformed the industry into what it is referred to today, invoice factoring or account receivable factoring. The factoring industry continued to grow in all sectors of the economy. When the Savings & Loan crises hit in 1980’s banks needed assistance with their customers and factoring provided the necessary financing. Again in 2008 the U.S. economy plunged, and factoring companies provided the money needed to keep businesses afloat. As long as businesses have a need for additional working capital, entrepreneurs will turn to receivable factoring to finance their success.

As a 43 year old factoring company, American Receivable has also evolved. In 1978 transactions were hand posted on ledger cards and accounting paper. Technology has brought many changes, what has not changed is our commitment to provide Top Rated Factoring service at competitive rates to help our clients grow and succeed. Call us today to learn how the team at American Receivable can put you on the fast track to success!