How to Grow Your Small Business

5 Tips to Grow Your Small Business Over half a million Americans start new businesses each month but about one-quarter of all new businesses fail within the first four years According to a recent Business 2 Community article by contributor Sarah Daren, one of the biggest challenges for entrepreneurs is inadequate cash flow. “Many small […]

Referral Sources Prove Valuable Again To American Receivable

American Receivable thanks our referral sources for these new clients! IT Staffing in Arizona. Needs factoring to cashflow a new government contract. $350k a month. Wire Manufacturing in Illinois. Established company sold, new owner using factoring to cover operating costs. $725k a month. Oil & Gas Service company in Texas. Customer extended payment terms. ARC […]

American Receivable Celebrates National Small Business Week

Even though we are 43 year old company, American Receivable still identifies as a small business. Our founders are still involved in daily operations and management. The lessons they have learned are passed on to our staff clients. Over the years as we have helped so many small businesses achieve their goals American Receivable has […]

Good News! Positive Cash Flow Is a Click Away

Business owners are scrambling to hire more employees to take advantage of the growing economy. Another challenge entrepreneurs must solve is finding the cash to finance a growing company. For 43 years American Receivable has helped both small and medium sized business meet payroll, pay for daily operations, and grow their business. By taking advantage […]

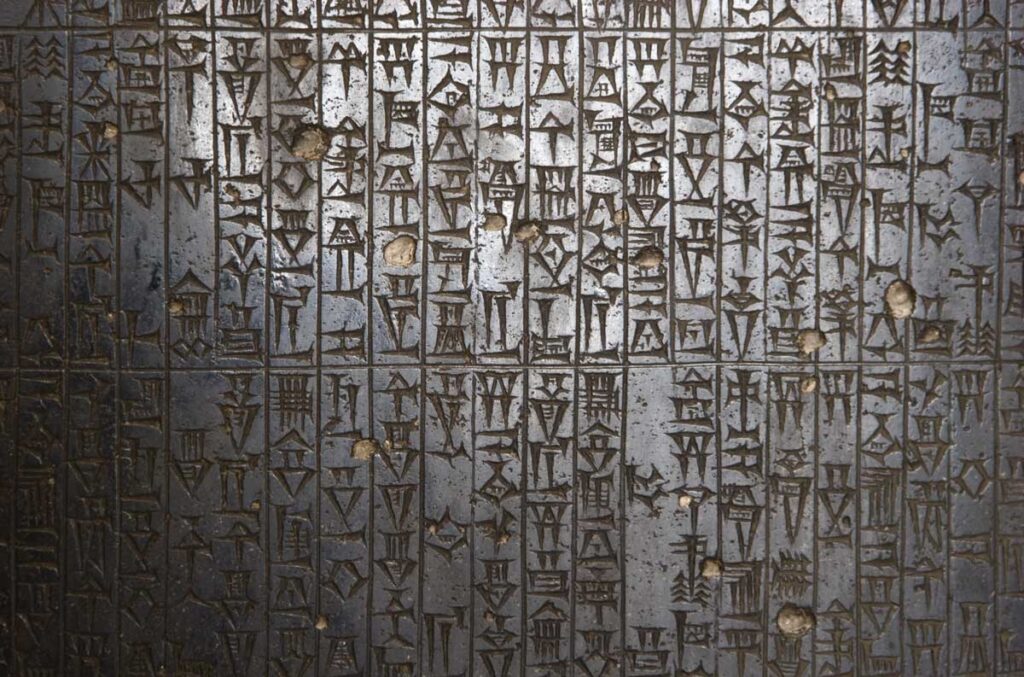

The History Of Factoring

The need for financing to facilitate commerce created factoring. First found in the Mesopotamian culture, the laws of factoring are lined out the Code of Hammurabi. Factoring was instrumental to international commerce in England in the 1400’s and was essential to financing the growing North American colonies. Even the famous trip the pilgrims took on […]

Four Warning Signs of Predatory Lending

As many small businesses are recovering from the pandemic, scammers and predatory lenders are taking advantage of businesses searching for funding. As the Paycheck Protection Program is over and approvals for bank loans has dropped by 20%, this gap in funding is making business owners a bigger target to the vultures masquerading as legitimate funding […]

Factoring For Success

Factoring Benefits: Online application, Funding in 2-3 days Factoring $10,000 to $2 Million per month Up to 95% advance No upfront fees or points No minimums Transparent pricing We understand that our prospects are busy, so we have streamlined our application. We never ask for historical financials, tax documents or personal financial statements. ARC has […]

Avoid These 4 Common Mistakes Financing Your Business

Every business owner knows it takes money to make money. While a business owner is adding employees and renting additional space to take on larger contracts it’s crucial that financing for this growth is already in place. Financing and cash flow issues is one of the top reasons that business fail with in their first […]

Gearing Up For Growth With Invoice Factoring

If you are a business owner, you understand how difficult it can be get invoices paid on-time. When customers are slow to pay their bills, this puts undue stress on your company’s cash flow, making it challenging to buy more supplies and make payroll. Invoice factoring is the perfect solution to support ongoing growth by […]

How the Pandemic Has Affected Small Business Financing

From the red hot economy of 2018 and early 2019 to government mandated shutdowns and supply shortages, small and medium sized business owners have had to both pivot and adapt to survive the pandemic. Banks and small business financing companies were not excluded from this scenario. Congress had the biggest influence in the economy by […]