Accounts Receivable Factoring by the

#1 Ranked Factoring Company in the U.S.

Accounts Receivable factoring is a widely-used form of financing among growing companies, recovering businesses, and entrepreneurs. Many of the largest and most stable corporations in America and Europe utilize invoice factoring as a means to speed up their cash flow so that they can seize opportunities to increase their market share.

Get a Quick Quote

What Makes American Receivable Your Best Factoring Choice?

- Ranked #1 among factoring companies

- No long term commitment

- No monthly minimums or maximums

- Rates starting as low as .8%, with up to 95% advances

Ranked the #1 Factoring Company by Business.com

Advantages of Accounts Receivable Factoring vs Traditional Financing

- Accounts Receivable factoring provides an unlimited line of working capital, limited only by the amount of business you can generate, not on the amount of your assets

- You qualify for cash advances based on your customer’s creditworthiness, not yours

- Accounts Receivable factoring does not increase your debt position

- Accounts Receivable factoring can help improve your credit rating & collections

- New orders generate cash within 24 hours – not 60 days

- No time-consuming audits are required – and no restrictions on the use of proceeds

Watch the Video to Learn How Factoring Works

Contact American Receivable today at 972-404-4726

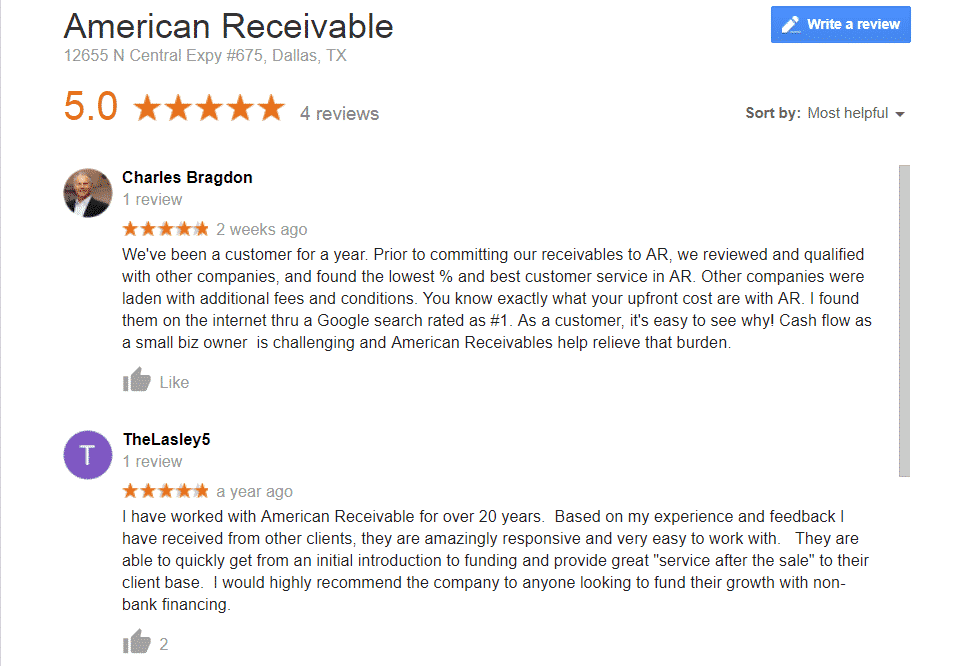

Check Out Our Google Reviews

[vc_row full_width=”stretch_row” css=”.vc_custom_1509718553903{padding-top: 70px !important;padding-bottom: 70px !important;background-image: url(https://americanreceivable.com/wp-content/uploads/2017/10/main-mast-financing.jpg?id=743) !important;}”][vc_column][vc_column_text]