American Receivable

Your Best Choice for Invoice Factoring

Invoice factoring is a widely-used form of financing among growing companies, recovering businesses and entrepreneurs.Many of the largest and most stable corporations in America and Europe utilize invoice factoring as a means to speed up their cash flow so that they can seize opportunities to increase their market share.

Get a Quick Quote

What Makes American Receivable Your Best Factoring Choice?

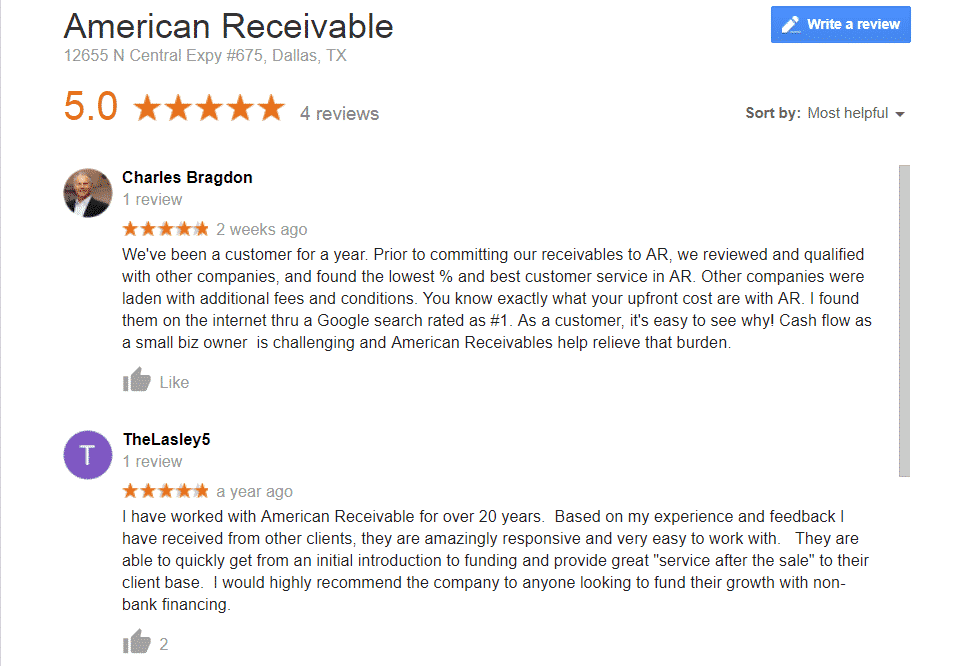

- Ranked #1 among factoring companies

- No long term commitment

- No monthly minimums or maximums

- Rates starting as low as .8%, with up to 95% advances

Ranked the #1 Factoring Company by Business.com

Advantages of Invoice Factoring over Traditional Financing

- Invoice factoring provides an unlimited line of working capital, limited only by the amount of business you can generate, not on the amount of your assets

- You qualify for cash advances based on your customer’s creditworthiness, not yours

- Invoice factoring does not increase your debt position

- Invoice factoring can help improve your credit rating & collections

- New orders generate cash within 24 hours – not 60 days

- No time-consuming audits are required – and no restrictions on the use of proceeds

Watch the Video to Learn How Factoring Works

Contact American Receivable today at 972-404-4726