Is Your Business Prepared for an Emergency?

Natural disasters can happen anywhere and at any time. Over the past several weeks North Texas has already suffered through several tornados – and the storm season has only now started. In 2019 our office building was heavily damaged by a storm. For several weeks our building was closed as they assessed the damage. Tornados, […]

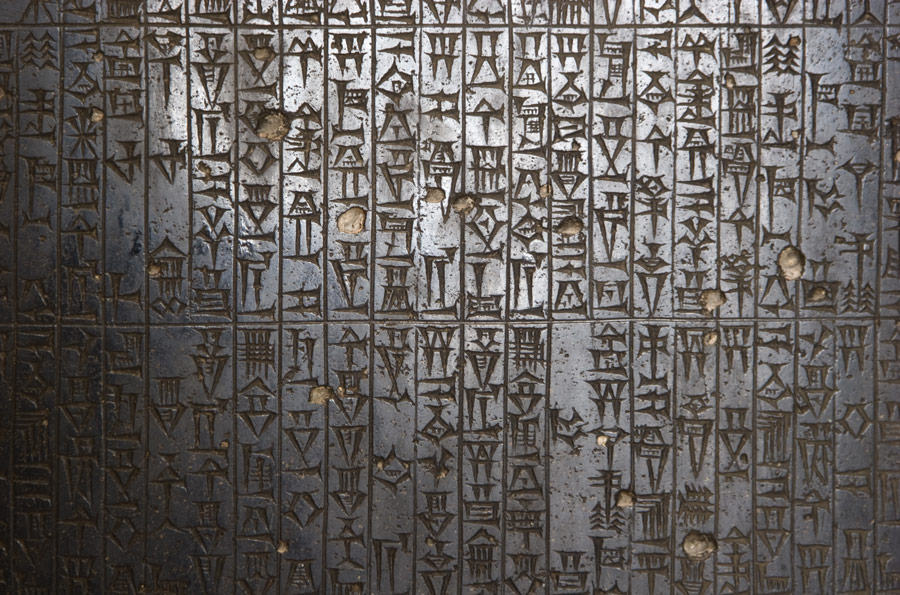

The Evolution of Receivable Factoring

Factoring has been around for centuries. Business owners have always had a need for additional financing. And factoring accounts receivable has always been a reliable source of alternative finance. Still, factoring is typically a small part of the curriculum in most university finance departments. Let’s take a look at the history and evolution of receivable […]

Speed Up Your Cashflow

The Small Business Administration cites that over 50% of businesses fail in their first five years. Most of the business owners listed negative cash flow as the number one reason they had to close doors. Negative cash flow can limit your ability to pay bills on time, limits growth opportunities and ultimately forces a business […]

How Does Accounts Receivable Factoring Help Growing Businesses?

Account Receivable factoring, also known as invoice financing, is a widely used method of financing a business. The factoring industry is now a 3 trillion Dollar industry worldwide! The growth in the factoring industry has been fueled by both economic expansion and the growing start-up economy. Hassle-Free Factoring The process of factoring account receivables is […]

A Saint Patrick’s Day Reminder

Jack “Ryan” Stieber wants you to always remember:“If you’re lucky enough to be Irish, you’re lucky enough!” Happy Saint Patrick’s Day from all of us at American Receivable

Be Prepared To Find Funding

As banks are growing more conservative in their lending, many business owners are being turned down for a bank loan. Since the need for additional capital did not disappear when a loan request is denied, business owners will look to alternative lenders to meet their need. Accounts receivable factoring is the solution. Like applying for […]

Invoice Factoring: A Wise Choice Over Credit Cards

Starting any business is always a capital intensive endeavor. Many business owners are forced to use their own personal credit cards to supplement the cash they have raised to get their business running. This strategy can be successful but can be very costly to both the company and the business owner. There are many financing […]

How a Factoring Company Can Help Your Staffing Company Flourish

Many companies are outsourcing a large portion of their hiring to staffing companies. But it can be extremely difficult for a start-up or a fast-growing staffing company to keep ahead of its payroll. Because staffing companies usually pay their employees on a daily or weekly basis, waiting a month or more for customers to pay […]

Celebrating 43 Years of Helping Companies Succeed

American Receivable is celebrating two significant events. First, this year marks our 43rd year of helping our clients grow and succeed. In 1979 a couple of recent college graduates thought it would be a good idea to start their own factoring company. Starting with a small amount of family money, the two founders are still […]

Use Your Corporate Culture to Keep Your Best Employees

Finding good employees is always challenging. Keeping good employees is critical. When employees are not happy with the company work environment and other jobs are available, they are likely to leave for greener pastures. Nurturing a positive corporate culture will improve morale and increase employee retention. The best job seekers want to work at a […]