American Receivable Corporation Has Been Rated #1 Among Factoring Companies…

…nationally, for the 5th consecutive year by Business.com and Business News Daily! – “Best Factoring Companies 2019.”

American Receivable has been working with small business owners helping them manage continuous growth through cash flow solutions.

Jack Stieber, President of American Receivable says they attribute their success to their clients, their exceptional working partnerships within the financial industry, and an incredible tenured and dedicated management team providing exceptional customer service.

“We work with each client to find cash flow solutions specific to their business needs because not all businesses or industries are alike.” Jack Stieber

American Receivable helps start-ups and established growing companies meet their goals by providing working capital essential to business operations. A business sometimes overlooks their greatest asset for working capital: revenue. American Receivable provides a way for small business owners to fund their business and keep cash flow positive without incurring debt through invoice factoring.

That’s not all…

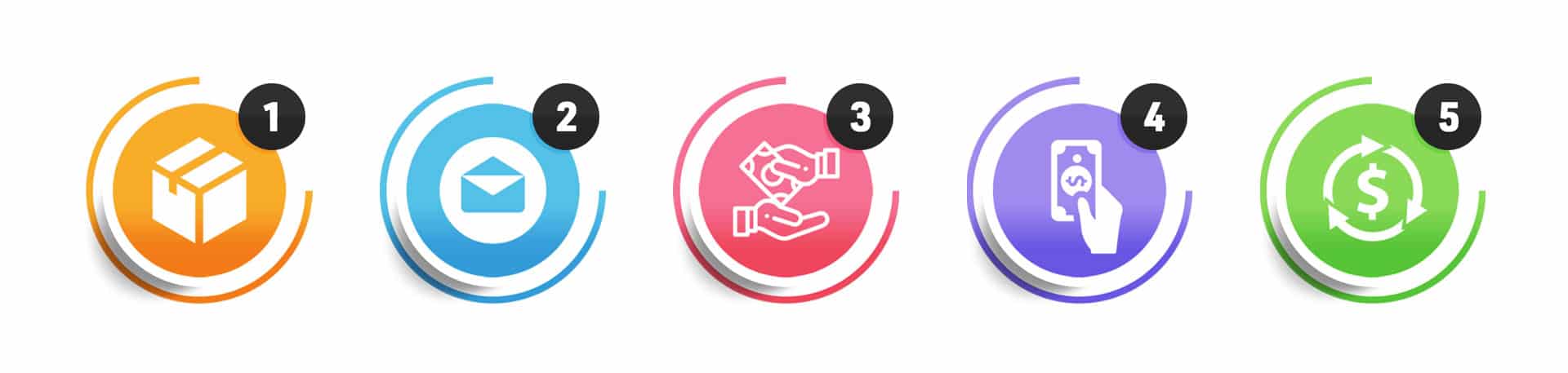

Taking advantage of invoice factoring is simple and easy – the process is made up of only 5 steps.

- You – the business owner will supply your customers with a product or service and then you invoice your customer directly.

- You send a copy of the open invoices to the factoring company for purchase.

- Upon verification of the invoices, the factoring company funds a percentage, usually 85-95% directly to you. Funding is within 24 hours in most cases.

- Your customers send payments for the invoices directly to the factoring company on your behalf.

- Once invoices are paid, the balance of the invoiced amount, less previously agreed upon fees, will be sent to you.

What you need to know:

Here are some things to consider when looking for a reputable invoice factoring company:

- Length of time the company has been in business.

- Are long-term contracts required or can I factor short-term?

- Are there up-front fees?

- What other services are offered if I factor with you?

- Are there extra fees for these other services?

- Do I have control over which invoices I sell to you?

- What is your fee structure?

- If you are a new business ask if they fund start-ups?

- Are you familiar with my industry?

- What is the application process and what is required?

- How long will it take to get approved?

- If my application is approved, how soon can I sell my invoices and be funded?

The best part…

…the glorious perks of doing business with a #1, nationally rated factoring company for the 5th consecutive year!

Factoring invoices close the funding gap caused by slow-paying customers because invoice factoring yields instant working capital!

Invoice factoring is a great alternative for a business owner who might not otherwise be able to acquire capital from traditional sources due to weak personal credit, lack of collateral, or length of time in business. Invoices for delivered products or completed work can be one of the greatest assets for a business. Invoices represent revenue for the company. Invoice factoring is an option to fund your business through the revenues of the business, therefore, not incurring additional debt for the business. Receiving the major percentage of the invoices up front, allows the business owner to operate with a positive and consistent cash flow, which is crucial for any business to operate smoothly and manage growth. American Receivable monitors the receivables and collections they purchase from a business. Assisting with collecting past due funds gives the business owner the ability to focus on managing and promoting the business.

Many business owners are unaware of the value of their unpaid invoices. Slow-paying customers can hold a business back. Factoring those valuable invoices is the answer to keeping cash flowing and not adding more debt for the company.

About American Receivable: Since 1979, American Receivable has provided small businesses with the financial resources they need to grow, increase inventory, make payroll on time and effectively compete in the marketplace. Operated and managed by the original Managing Partners, American Receivable earned the respect of the financial industry for their personal attention to their clients. They offer exceptional client services and have a very knowledgeable and tenured management team. Don’t wait, get started today – click here to send us an email!