Building a Strong Relationship With Your Bank

As a business owner, your relationship with your bank plays a crucial role in the success of your venture. It’s no secret that big banks dominate the financial landscape, holding a significant portion of deposits. However, recent statistics show that while these banks hold 63% of all deposits, they only account for 28% of small […]

Beware of Online Money Lenders

Today, business owners have a wide range of financing options, including online business lenders. However, not all online lenders are created equal, making it challenging to differentiate between the good and the not-so-good ones. Merchant Cash Advance lenders have earned the reputation of not disclosing terms and hiding their costs. Online business lenders excel at […]

Receivable Factoring: A Tool To Scale Up

Receivable financing, also known as invoice factoring, is a financing tool where a business sells its account receivables, or open invoices, to a factoring company. This type of financing is increasingly being used by SME (small, medium enterprises) to support their day to day working capital needs and fund their growth plans. Benefits of Factoring […]

How Receivable Factoring Companies Can Benefit Your Company

When it comes to obtaining the necessary funds for your company’s growth, receivable factoring can be a game-changer. As a business owner, you understand that consistent cash flow is vital for operational expenses and seizing growth opportunities. That’s where invoices and accounts receivable play a crucial role. However, slow-paying customers or skipped payments can disrupt […]

Invoice Factoring Helps Make Payroll

As a small business owner, making payroll can be one of the biggest challenges that you face. Even if your business is doing well, there can be times when unexpected expenses or slow sales can make it difficult to meet your payroll obligations. If you are in this situation, it is important to take steps […]

Oilfield Service Companies Thrive With Invoice Factoring

Oilfield service companies play a critical role in the oil and gas industry by providing a range of services, such as drilling, well completion, welding, wastewater hauling and maintenance. However, these companies often face challenges related to slow-paying customers, which can hamper their ability to grow their business. To address this issue, many oilfield service […]

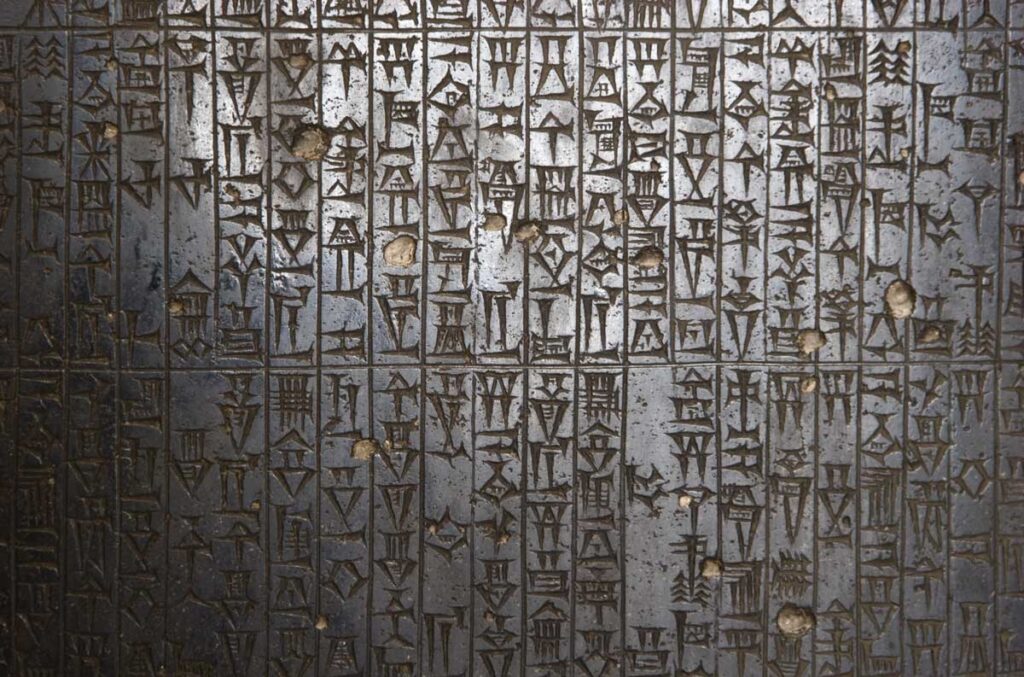

The History of Invoice Factoring

Invoice factoring is a financing option that allows businesses to sell their unpaid invoices to a factoring company or a factor, in exchange for immediate cash. This form of financing has been around for centuries and has played a crucial role in the growth and success of many businesses. The practice of factoring invoices can […]

American Receivable Provides Access to Capital to Women Entrepreneurs

When American Receivable opened it’s doors more than 44 years ago, it was the exception to see a woman owned business. Businesses were typically started and run by men who most often already had connections with customers, suppliers, and bankers. Those kind of connections are invaluable to any start up. As owners of a new […]

Accounts Receivable Funding Helps Staffing Companies

When a staffing company needs funds to grow their business, they typically turn to a bank for a loan. However, not all staffing companies are able to secure a loan from a bank due to their credit history or length of time in business. This is where accounts receivable funding, also known as factoring, comes […]

How To Raise Money for a Business Without a Loan

Starting a business requires a lot of money. While it’s tempting to just take out a loan, it’s not always the best option. Loans can be difficult to obtain, especially for new businesses without a proven track record. Plus, the added burden of debt can be overwhelming. Luckily, there are plenty of other ways to […]