Find Fast Cash for Growing Companies

Every business owner knows that happiness is a positive cash flow! But entrepreneurs can be caught in cash crunch when there are unexpected expenses or customers pay their invoices late. The long term fix for this is a detailed examination of every expense, an analysis of pricing and considering additional financing. This is a time […]

Five Ways To Prepare for a Recession

Economists generally define a recession by a fall in Gross Domestic Product for two successive quarters. Harry Truman had a more concrete definition, “If your neighbor gets laid off, it’s a recession. If you get laid off, it’s a depression.” Savvy business owners are preparing for an economic slowdown, without knowing it’s length or severity. […]

American Receivable Corporation Announces New Location in Austin, TX

American Receivable, the Top Rated factoring company, is expanding its enterprise and has opened a new business development office in Austin, Texas. The office is manned by Dakota Stieber who is starting his twelfth year with ARC. Dakota started his career at American Receivable in the back office and has moved up to Vice President […]

Austin Entrepreneurs Finding Success with American Receivable

“When you’re thirsty, it’s too late to start digging a well.” This is also true for building a relationship with an Austin factoring company. By starting your search for the right invoice factoring company before you have a desperate need, will allow you to make a thorough investigation and chose the factor that works best […]

Are You Ready to Be An Entrepreneur?

It takes many skills to start and manage your own company. Many founders wish they had learned some of those skills in school instead of on the job. Whether trying to land a new client or manage employees, entrepreneurs are constantly faced with situations they were not trained to handle. In hindsight, many founders wish […]

Invoice Factoring for Austin Entrepreneurs

Successful entrepreneurs know that it always pays to have plenty of options. Most importantly options for: Employees Vendors Customers Funding By having several suppliers an entrepreneur can obtain the best prices for inventory. A choice of employees means that an entrepreneur can withstand employee turnover. A steady stream of customers assures strong margins and a […]

Five Ways to Avoid Slow Paying Customers

What happens when a customers starts taking longer to pay your invoices? Your cash flow slows down, hindering your ability to cover payroll and other operating expenses. However, a business owner must be cautious when demanding payment from their customers. While you do not want to jeopardize future business, you have to maintain your own […]

Go Independent for the Best in Factoring

The longer you run your own company, the more you value a partner that is on your side and is always honest about what they can deliver. For a growing business, choosing the right factoring company can be the difference between continued growth and hitting a wall. Invoice factoring companies have traditionally been independently owned […]

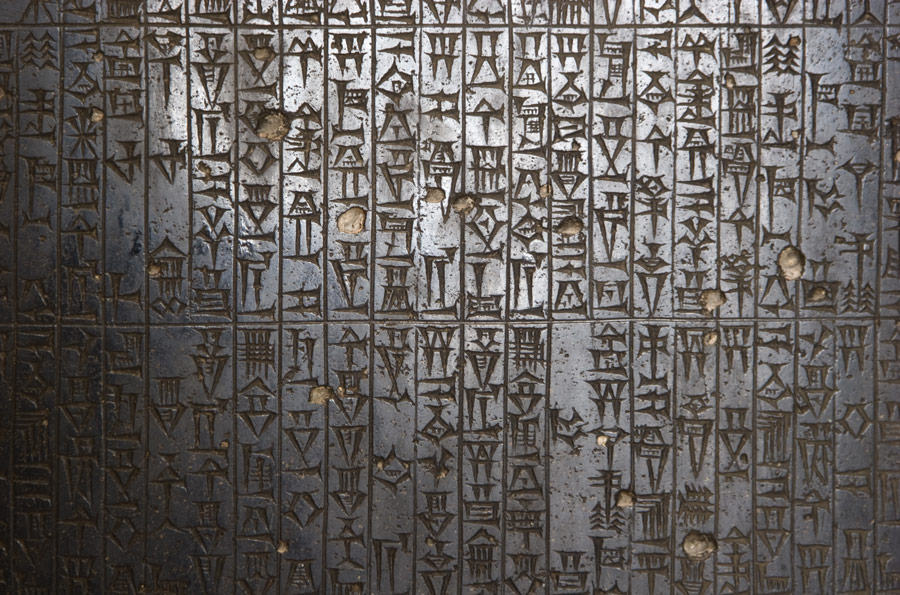

The Evolution of Receivable Factoring

Factoring has been around for centuries. Business owners have always had a need for additional financing. And factoring accounts receivable has always been a reliable source of alternative finance. Still, factoring is typically a small part of the curriculum in most university finance departments. Let’s take a look at the history and evolution of receivable […]

Invoice Factoring: A Wise Choice Over Credit Cards

Starting any business is always a capital intensive endeavor. Many business owners are forced to use their own personal credit cards to supplement the cash they have raised to get their business running. This strategy can be successful but can be very costly to both the company and the business owner. There are many financing […]