Top 5 Reasons to Utilize a Factoring Company

Running a successful business requires consistent cash flow to maintain operations, pay employees, and invest in growth opportunities. Unfortunately, waiting for customers to pay their invoices can create gaps in cash flow, hindering your business’s ability to thrive. This is where a factoring company comes in. Factoring companies provide a valuable service by purchasing outstanding […]

Factoring for Staffing Company: A Smart Financial Solution

Staffing companies play a critical role in connecting businesses with the talent they need. However, these companies often face unique financial challenges. The nature of their business requires them to pay employees weekly or bi-weekly while waiting for clients to settle their invoices, which could take 30, 60, or even 90 days. This gap in […]

Invoice Factoring Texas: A Smart Financial Solution for Growing Businesses

Running a business in Texas comes with its unique challenges and opportunities. From the thriving tech hubs of Austin and Dallas to the bustling ports of Houston, Texas businesses are in a constant race to maintain growth and manage cash flow effectively. In this competitive environment, businesses often face cash flow gaps due to delayed […]

Top 5 Reasons Factoring for Small Business Wins

Running a small business can be both exhilarating and challenging. One of the most common struggles for small businesses is managing cash flow. As expenses pile up, waiting for clients to pay their invoices can put a strain on operations and hinder growth. This is where factoring for small business comes into play. By turning […]

Why American Receivable is the Best Rated Accounts Receivable Factoring Company

When searching for the best “Accounts Receivable Factoring Companies,” it’s crucial to find a partner that understands your business needs and offers tailored solutions to help you thrive. American Receivable has been leading the charge for over 45 years, providing businesses with the financial flexibility they need to grow and succeed. This long-standing reputation is […]

Invoice Factoring for Start-Ups, a Key Step to Success

Starting a business is an exciting yet challenging endeavor. Entrepreneurs often find themselves juggling numerous tasks, from product development to marketing, all while trying to manage their finances. One of the most significant hurdles that start-ups face is maintaining a healthy cash flow, especially in the early stages when revenue is just beginning to trickle […]

Manufacturing Companies Turn to Invoice Factoring Companies

Manufacturing companies are the backbone of the economy, producing goods that fuel various industries and support the daily lives of millions. However, despite their crucial role, manufacturing businesses often face cash flow challenges that can hinder growth and stability. For many, the solution lies in partnering with invoice factoring companies. Invoice factoring is a financial […]

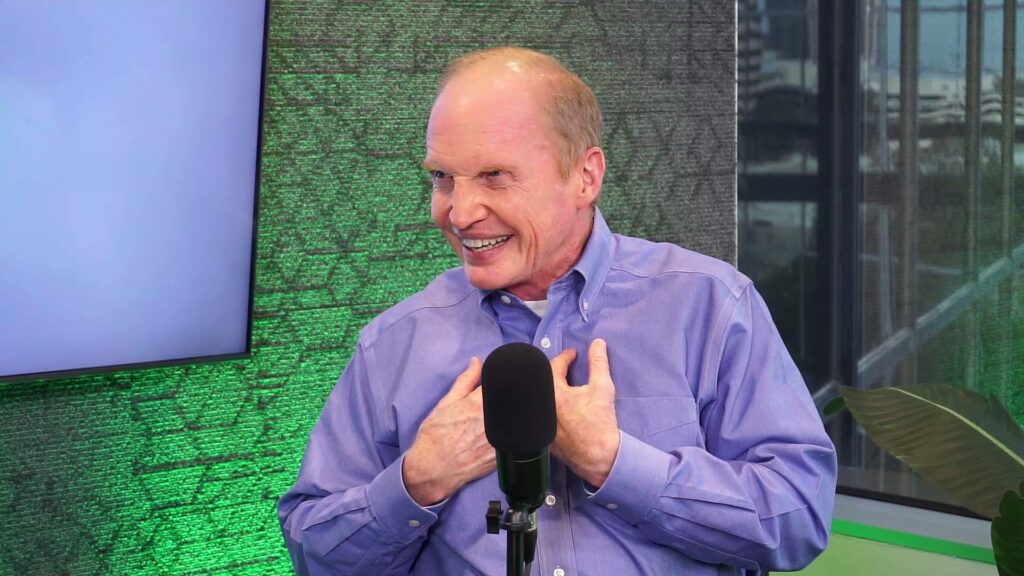

Celebrating Brad Gurney’s 66th Birthday: A Legacy of Success in the World of Invoice Factoring

Dallas, TX – American Receivable, a leading invoice factoring company in Dallas, TX, is proud to celebrate the 66th birthday of its founder, Brad Gurney. With over four decades of experience in the industry, Brad has been a driving force behind the company’s success and continues to be actively involved in its daily operations. Brad […]

Factoring Company Helps Machine Shop Go For the Gold!

When a machine shop in Texas secured a contract with a prominent manufacturer, the future seemed promising. This new customer was set to increase their sales tenfold, propelling them to new heights. However, the excitement was soon tempered by a challenge many businesses face when experiencing rapid growth—financing that growth. The Challenge: Bank Hesitancy Due […]

IT Staffing Company Prospers with Factoring

In the fast-paced world of information technology, staffing companies play a critical role in connecting talented professionals with organizations in need of specialized skills. However, managing cash flow can be a significant challenge for these companies, particularly when their growth outpaces their available resources. This is where staffing company factoring comes into play, offering a […]