Receivable Factoring: A Tool To Scale Up

Receivable financing, also known as invoice factoring, is a financing tool where a business sells its account receivables, or open invoices, to a factoring company. This type of financing is increasingly being used by SME (small, medium enterprises) to support their day to day working capital needs and fund their growth plans. Benefits of Factoring […]

How Receivable Factoring Companies Can Benefit Your Company

When it comes to obtaining the necessary funds for your company’s growth, receivable factoring can be a game-changer. As a business owner, you understand that consistent cash flow is vital for operational expenses and seizing growth opportunities. That’s where invoices and accounts receivable play a crucial role. However, slow-paying customers or skipped payments can disrupt […]

Run a Tight Ship

Running a tight ship is essential to the survival of your business. In order to maximize profit, the entrepreneur has to make sure that they have a tight system in place from on-boarding a new customer to receiving and accounting for payments.

Invoice Factoring Helps Make Payroll

As a small business owner, making payroll can be one of the biggest challenges that you face. Even if your business is doing well, there can be times when unexpected expenses or slow sales can make it difficult to meet your payroll obligations. If you are in this situation, it is important to take steps […]

Machine Shops Benefit From Invoice Factoring With American Receivable

Machine shops play a vital role in the manufacturing industry by producing precision parts for various industries, such as aerospace, automotive, and medical devices. However, like many small and mid-sized businesses, machine shops often face challenges related to slow-paying customers and limited access to financing. To address these challenges, many machine shops are turning to […]

Oilfield Service Companies Thrive With Invoice Factoring

Oilfield service companies play a critical role in the oil and gas industry by providing a range of services, such as drilling, well completion, welding, wastewater hauling and maintenance. However, these companies often face challenges related to slow-paying customers, which can hamper their ability to grow their business. To address this issue, many oilfield service […]

Pick the Right Bank for Your Business

With the recent bank failures many business owners are reexamining their banking relationship. Having a supportive bank on your team is always important. Even more so now in light of a slowing economy and the worry of some banks getting caught in an interest rate squeeze. Bigger is not always Better It may be tempting […]

Austin Manufacturers Benefit From Factoring

Manufacturing companies in Austin, Texas are experiencing unprecedented challenges in the wake of the COVID-19 pandemic. With banks’ lending less, traditional financing options are no longer viable for many businesses. Fortunately, factoring companies are stepping in to provide the necessary cash flow to keep manufacturing companies afloat and thriving. Invoice factoring is a financial transaction […]

5 Tips To Help Find a CPA for Your Business

There are many aspects of your business that require your attention as a business owner. Managing your finances is undoubtedly one of the most crucial. That’s where a Certified Public Accountant (CPA) comes in. A CPA can provide expert advice on tax planning, financial reporting, and other critical financial matters, helping you navigate the complexities […]

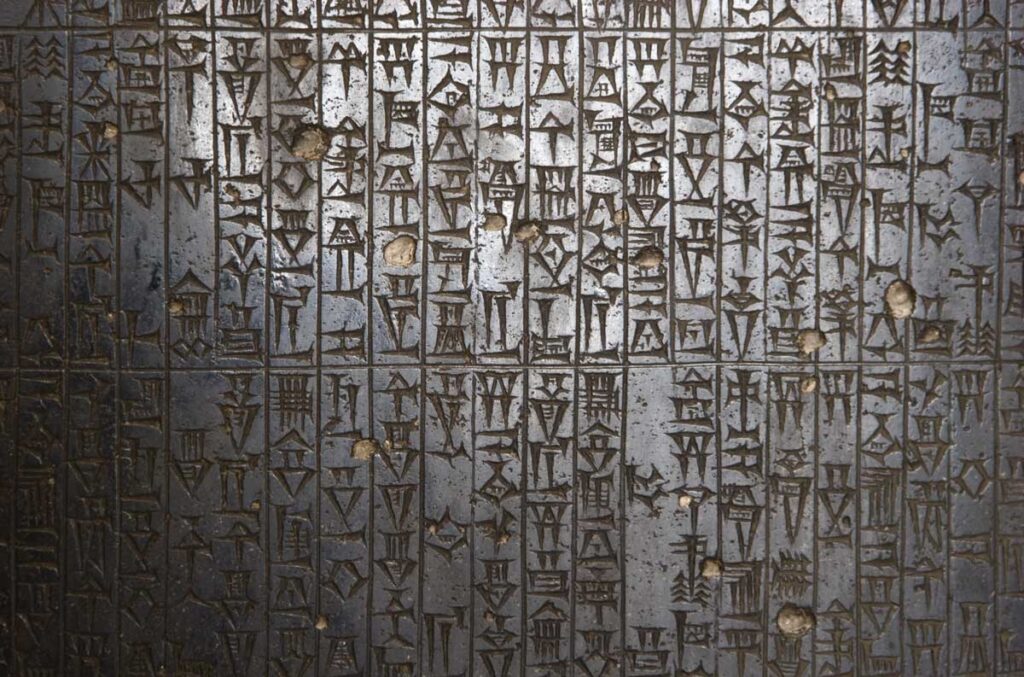

The History of Invoice Factoring

Invoice factoring is a financing option that allows businesses to sell their unpaid invoices to a factoring company or a factor, in exchange for immediate cash. This form of financing has been around for centuries and has played a crucial role in the growth and success of many businesses. The practice of factoring invoices can […]